1. European ecommerce to grow 45% in 5 years

Forrester predicts that online sales in Europe will grow from €389B in 2024 to €565B in 2029—a 7.8% annual growth rate! Meanwhile, offline retail will inch forward at just 1.7% per year.

Biggest Winners:

The UK, Germany, and France are leading the charge. By 2029:

- UK eCommerce will hit €207B, making up 32% of retail sales.

- Germany will see online sales jump to €146B (21% of retail sales).

- France will grow to €106B, with eCommerce holding a 17% share.

What does this mean for brands?

Retail is shifting fast. Those who embrace marketplace expansion, omnichannel strategies, and personalized shopping experiences will be best positioned to win.

2. Diversification in Amazon Marketplaces: A Smart Growth Strategy?

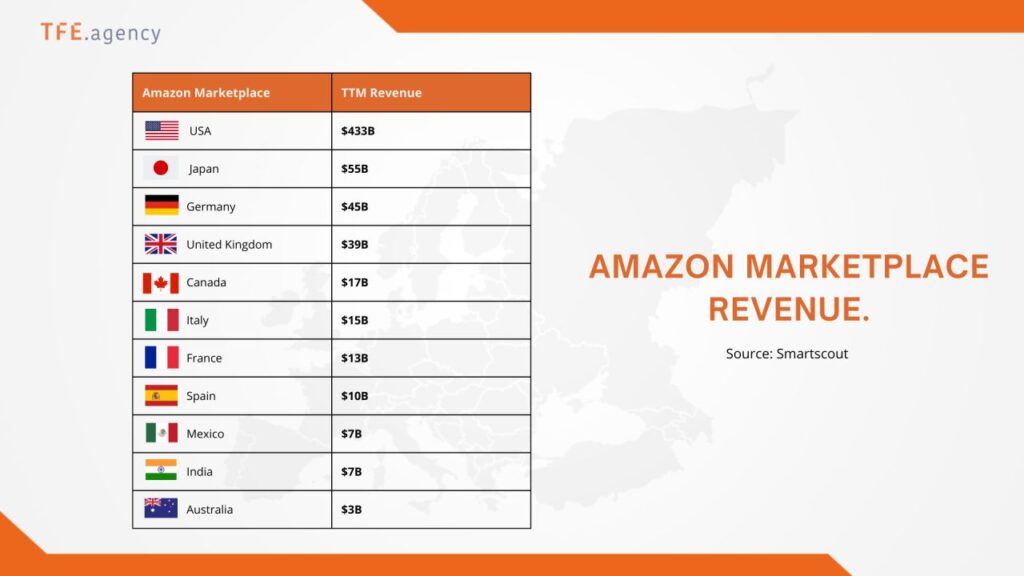

Amazon’s U.S. marketplace dominates with $433B in annual revenue, but its international markets collectively add up to a significant amount. While the U.S. remains the biggest opportunity, is putting all your eggs in one basket the best long-term strategy?

Why Diversification Matters:

- Market risks: Regulatory changes, shifting consumer trends, or increasing competition in the U.S. can impact sales.

- Untapped potential: Japan, Germany, and the UK are Amazon’s biggest non-U.S. markets, while Mexico, Spain, and India are growing rapidly.

- Currency & economic resilience: Operating in multiple regions helps mitigate fluctuations in exchange rates, inflation, and local economic downturns.

A Common Misconception:

Many sellers hesitate to expand due to perceived complexity—language barriers, logistics, compliance, and localization. But with the right partners, automation, and tools, these challenges are manageable.

Takeaway:

The U.S. is massive, but diversification across high-potential Amazon markets can drive long-term stability and revenue growth.

3. Price Management: A Key Lever to Boost E-Commerce Performance

In a fast-moving market where competition is fierce, pricing is more than just a number—it’s a strategy. With 83% of consumers comparing prices before making a purchase, staying ahead requires active price management.

Why does it matter?

- Pricing errors can eat into your margins.

- Non-competitive prices = lost market share.

- The right pricing strategy can increase visibility, profitability, and sales.

Effective Strategies:

- Cost-Based Pricing – Covers expenses but may lack market agility.

- Competitive Pricing – Aligns with market trends but requires constant monitoring.

- Dynamic Pricing – Adjusts in real time based on demand, seasonality, and competition.

Actionable Insights:

Businesses leveraging smart pricing solutions can react faster, optimize profits, and stand out in crowded marketplaces like Amazon, eBay, or Leroy Merlin.

4.  E-commerce in France 2024: Online Sales Exceed €175 Billion!

E-commerce in France 2024: Online Sales Exceed €175 Billion!

In 2024, French e-commerce continued its strong momentum, reaching a record €175.3 billion, a 9.6% increase YoY. This growth was fueled by higher transaction volumes and the easing of inflation.

Key Figures:

- Total online sales: €175.3B (+9.6%)

- Product sales: €66.9B (+6%)

- Services sector: €108.4B (+12%)

- Online transactions: 2.6B (+10%)

- Average basket size: €68

- Annual online spend per buyer: €4,216

Growth Drivers:

- Inflation slowdown, increasing consumer confidence.

- More buyers seek affordable options and better value.

- Product sales make a comeback after two slower years.

- The services sector remains a key driver, particularly in travel & leisure.

With e-commerce now making up 11% of total retail sales, staying ahead of trends like pricing strategies, product penetration, and omnichannel integration will be crucial.

5.  What does it take to scale a brand in digital marketplaces?

What does it take to scale a brand in digital marketplaces?

At TFE Agency, we go beyond just selling online—we provide the infrastructure, operational support, and strategic insights brands need to scale sustainably across marketplaces.

Scaling Digital Sales: How TFE Agency Helps Brands Grow

Managing multiple sales channels, optimizing visibility, and handling logistics require expertise, technology, and adaptability. We help brands expand seamlessly—without the growing pains.

Marketplaces as a Growth Engine

With 60%+ of marketplace sales coming from external sellers, brands have an enormous opportunity—but also face algorithm shifts, compliance hurdles, and customer service demands. We navigate these complexities to maximize every platform while staying compliant and efficient.

Breaking Growth Plateaus

Many brands launch successfully but struggle to scale further. Growth often demands new investments in people, expertise, and tools, making ROI unclear. We provide the infrastructure and operational expertise to help brands break through plateaus, expand reach, and maintain efficiency.

Expanding to New Marketplaces

Selling on multiple platforms requires understanding marketplace algorithms, compliance protocols, and customer interactions. We ensure smooth expansion, from onboarding to listing optimization, managing operations across channels with ease.

Overcoming Logistics & Fulfillment Challenges

Scalable logistics solutions are crucial for success. We help brands manage inventory, streamline fulfillment, and meet marketplace standards—ensuring speed, efficiency, and customer satisfaction.

Optimized Content for Maximum Visibility

Each marketplace has its own content rules. To stand out, brands need tailored product listings—optimized titles, images, and descriptions that align with platform algorithms.

Advertising & Promotions That Drive Sales

Marketplace advertising is key to staying competitive. We help brands leverage shopping events, optimize promotions, and run targeted campaigns to increase visibility and maximize ROI.

Scaling Without the Headaches

Managing multiple digital sales channels while running a brand can be overwhelming. At TFE Agency, we offer end-to-end marketplace management, so brands can scale without building large teams or struggling with trial-and-error strategies.

6. Europe: A Leading Hub for Ecommerce Headquarters

With 95 of the world’s 250 largest ecommerce companies based in Europe, the continent holds a 38% share—leading North & South America (37%) and Asia (23%).

Germany leads with 22 HQs (Otto, Zalando, About You).

Germany leads with 22 HQs (Otto, Zalando, About You).

France & the UK follow with 17 each.

France & the UK follow with 17 each. Global Leaders? The U.S. dominates with 80 HQs, while China has 17.

Global Leaders? The U.S. dominates with 80 HQs, while China has 17.

Despite its strong presence, Europe lacks representation in the global top 10 ecommerce firms—Amazon and Alibaba lead the way.

How can European ecommerce players compete on a global scale?

Final Thoughts

Final Thoughts

As e-commerce continues to evolve, brands must stay agile and proactive in adapting to new trends. Whether it’s marketplace expansion, pricing strategies, or digital transformation, the opportunities for growth are immense. The key is to embrace innovation, leverage the right expertise, and strategically position your brand for long-term success.

What are your thoughts on the future of e-commerce in 2025? Let’s continue the conversation!

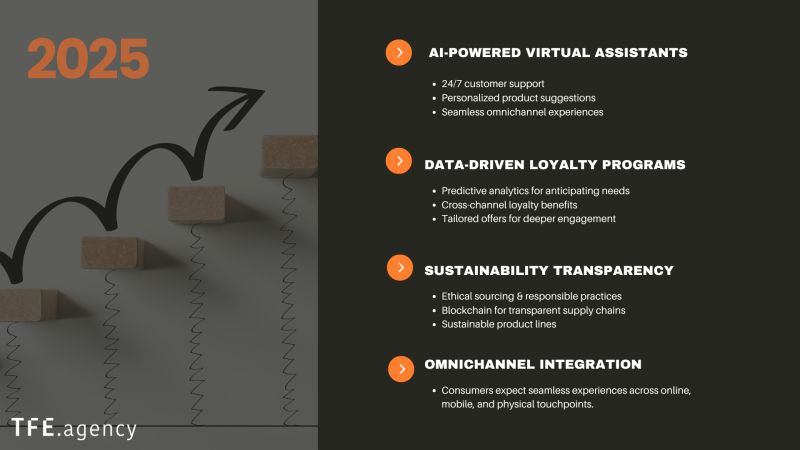

]]>1. What to Expect in 2025 and Beyond: Transforming Retail and E-Commerce

The retail and e-commerce landscape continues to evolve rapidly, shaped by consumer expectations, technological advancements, and sustainability efforts.

Key Trends to Watch:

- AI-Powered Retail Transformation: Hyper-personalized shopping experiences, virtual assistants, and predictive analytics are becoming the norm.

- Data-Driven Loyalty Programs: Brands are leveraging AI to offer tailored promotions and cross-channel benefits.

- Sustainability Transparency: Ethical sourcing and eco-friendly practices are gaining consumer trust.

Actionable Steps:

- Invest in AI-driven personalization and data integration.

- Prioritize sustainability initiatives.

- Enhance in-store experiences with immersive technology.

By embracing innovation, businesses can align with consumer values and thrive in the evolving retail landscape of 2025.

2. Exploring the 2025 Shifts in Marketplace Shopping Behavior

The “Marketplace Shopping Behavior Report 2025” by ChannelEngine highlighted transformative trends across France, Germany, the Netherlands, the UK, and the US.

Key Insights:

- Marketplaces as Primary Search Engines: 47% of consumers start product searches on marketplaces instead of Google.

- Consumer Research and Impulse Buying: Shoppers spend between 54-94 minutes researching purchases, with over half making impulse buys.

- Trust Challenges: Concerns over product quality and unreliable sellers remain obstacles for marketplaces.

- Multi-Channel Strategies: Brands are expanding beyond single-platform sales to reach wider audiences.

Understanding these trends helps businesses optimize their marketplace strategies and stay ahead in the competitive landscape.

Full Report: https://lnkd.in/ehfGdsmY

3. Tesco Marketplace Surpasses 300,000 SKUs in Rapid Expansion

Tesco’s online marketplace has seen a 3,000% growth in just eight months since its launch in June 2024.

What’s Driving Tesco’s Success?

- Massive Product Expansion: Starting with 9,000 products, Tesco now offers items across homeware, DIY, toys, and pet care.

- Strategic Adjustments: Lessons from past marketplace failures (e.g., Tesco Direct) have informed a stronger, more scalable model.

- Competitive Positioning: With increasing demand for online shopping, Tesco is poised to challenge digital and traditional retail rivals.

Could Tesco become the dominant marketplace in the UK? Share your thoughts!

4. Strengthening Our eCommerce Expertise

We are thrilled to welcome a new expert with 24 years of e-commerce experience to our team!

What They Bring to TFE:

- Expertise in Amazon’s 1P (Vendor) and 3P (Marketplace) solutions.

- Experience in global markets (UK, EU, US, Japan, Australia).

- Proven success in marketing, automation, and cost reduction.

This marks a new chapter as we continue to provide top-tier marketplace support to help businesses succeed.

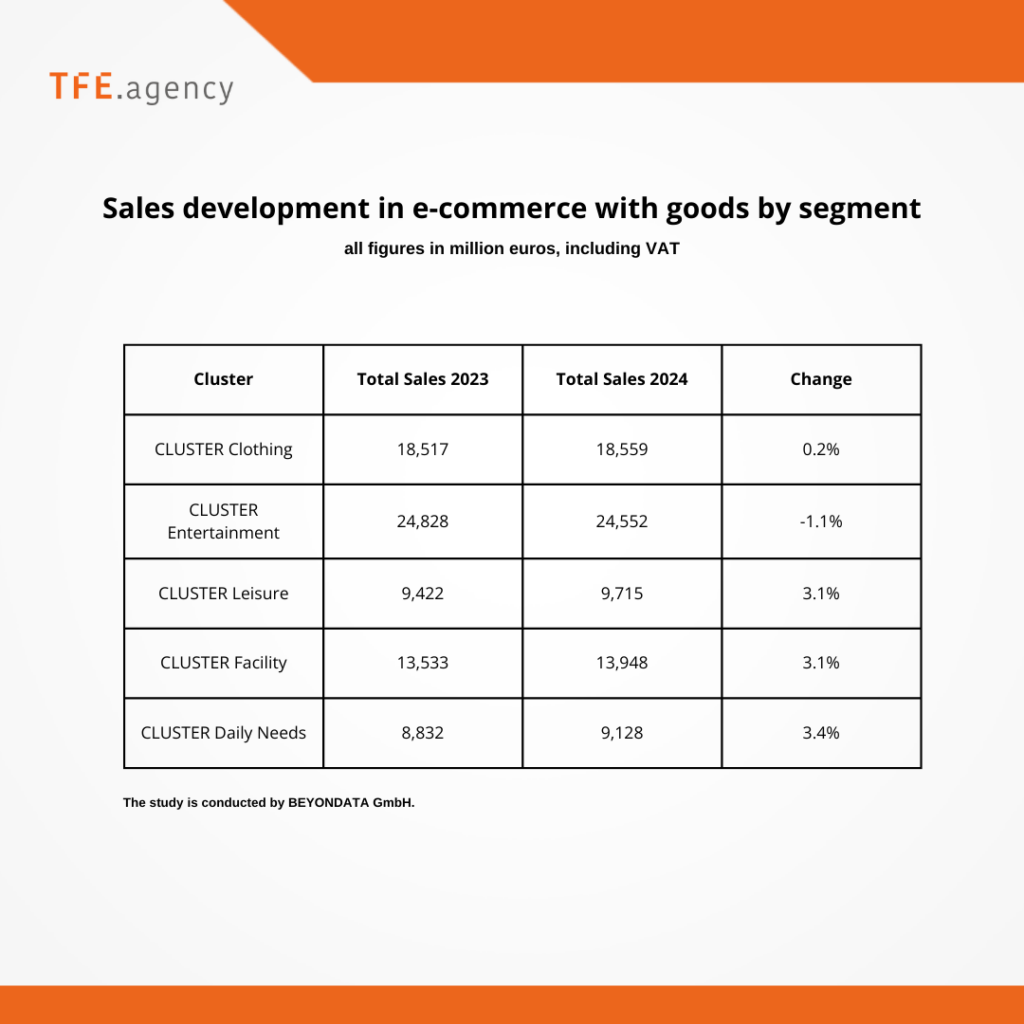

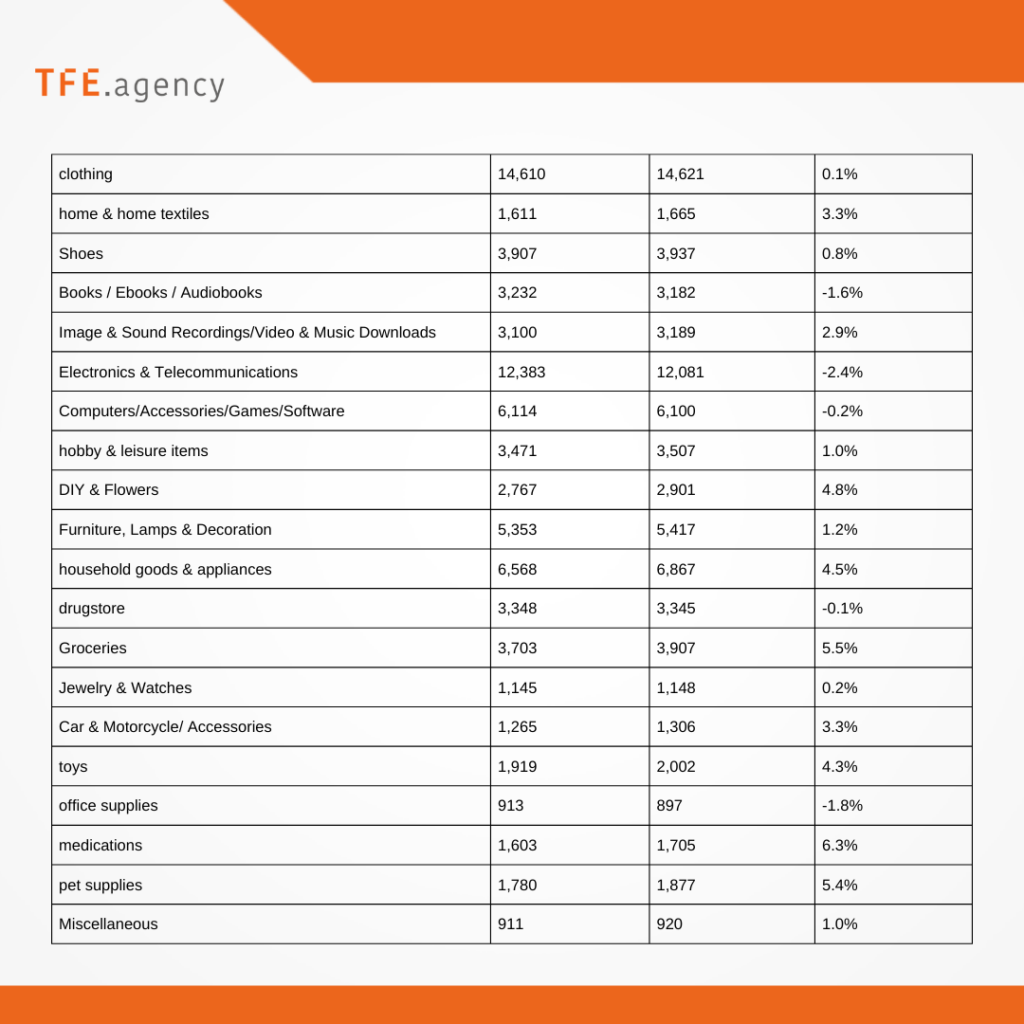

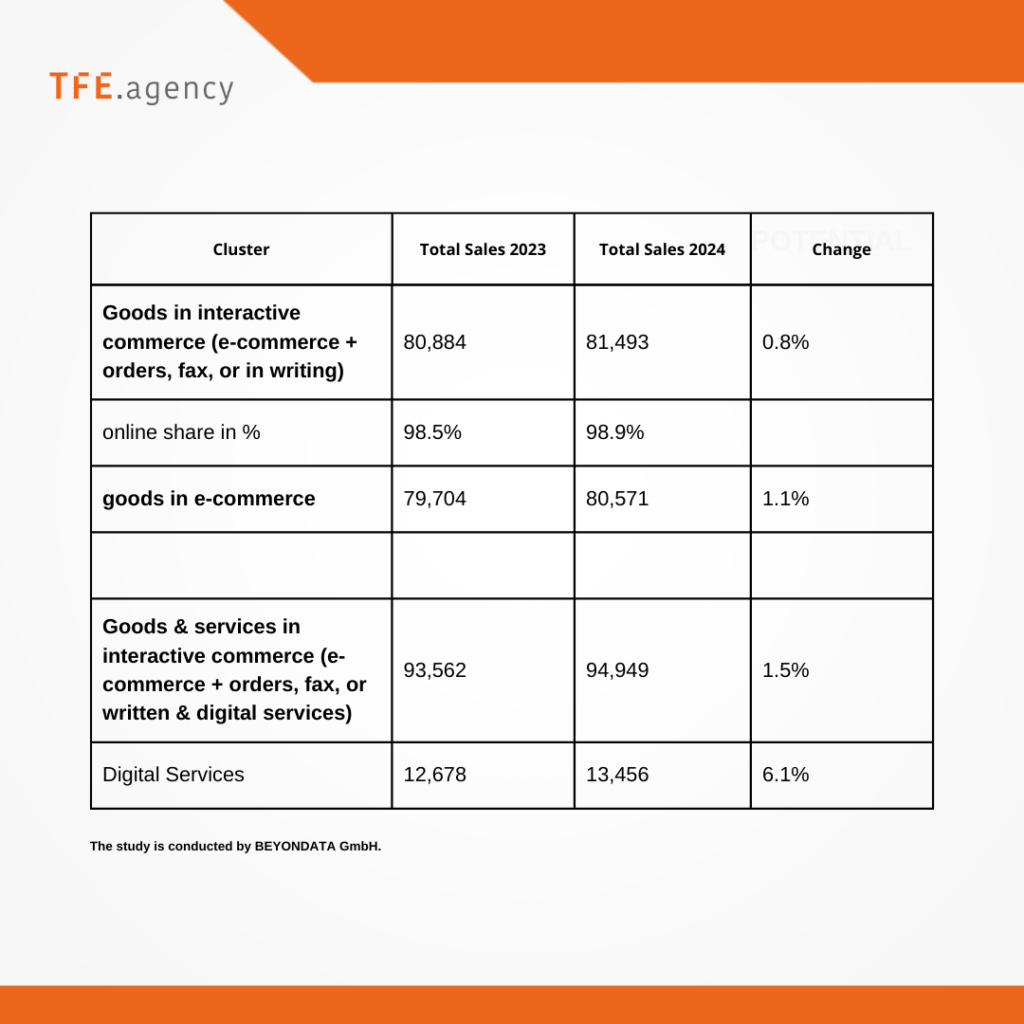

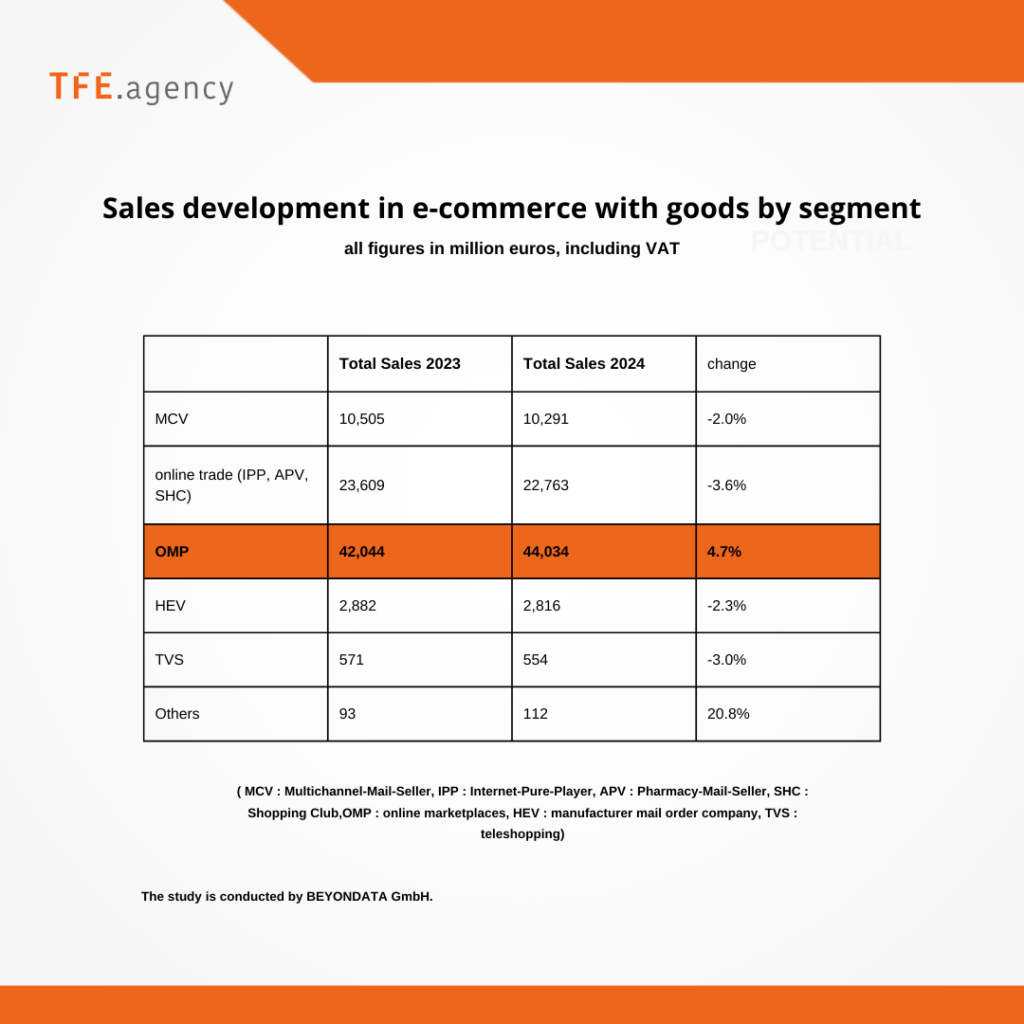

5. E-commerce in Germany: Back on the Growth Path

After two years of stagnation, German e-commerce saw a 1.1% growth in 2024, reaching €80.6 billion in sales.

Key Findings:

- Marketplace Domination: 55% of e-commerce sales come from online marketplaces.

- Growth in Essential Goods: Categories like medicine (+6.3%), food (+5.5%), and pet supplies (+5.4%) saw strong gains.

- Social Commerce on the Rise: 64.1% of young consumers and 20.1% of older shoppers made purchases via social media.

- Re-Commerce Boom: Over 50% of consumers participated in buying/selling second-hand goods.

With consumer optimism rising, German e-commerce is poised for further expansion in 2025.

6. Amazon’s Top Five Priorities in 2025

Amazon continues to dominate the e-commerce space, focusing on five key areas:

1. Faster Deliveries & Fulfillment Innovations

- Over 7 billion items delivered same/next day in 2023.

- Vision-Assisted Package Retrieval (VAPR) set to improve last-mile logistics.

- Expansion of Same-Day Delivery networks internationally.

2. Prime Air & Drone Deliveries

- MK30 drone can deliver in under 30 minutes.

- UK & Italy added to Amazon’s drone delivery regions.

3. Grocery Expansion

- Amazon Fresh extended to new cities.

- Competing with supermarkets by offering 30-minute grocery delivery.

4. Attracting International Sellers

- Expansion of Supply Chain by Amazon.

- New Regional Global Selling Centers supporting cross-border sales.

5. AI-Powered Operations with Nova Models

- Amazon Bedrock’s Nova AI enhances text, image, and video processing.

- Competitors are being pushed to innovate AI solutions.

Amazon’s aggressive strategies show how it plans to retain its market dominance while responding to competition from Temu, Tmall Global, and JD.com.

Full article: channelengine.com/en/blog/amazons-priorities

Final Thoughts

January has been an exciting month for e-commerce, with marketplace transformations, AI advancements, and retail innovations shaping the year ahead. As we continue to track these developments, staying adaptable and informed will be crucial for brands and retailers looking to thrive in 2025.

What are your thoughts on these trends? We’d love to hear your insights and experiences!

]]>For retailers, this critical update arrives at the busiest time of the year—right in the heart of Q4 and the pre-Christmas shipping rush. Here’s everything you need to know to prepare your business and avoid disruptions.ember state.

What Is the GPSR?

In May 2023, the EU published the new General Product Safety Regulation (GPSR) 2023/988 in the Official Journal of the European Union. After a transitional period of 18 months, the regulation will replace

Directive 2001/95/EC on 13 December 2024 and enter into force immediately in every EU member state.

The regulation is designed to address modern challenges in product safety, particularly for online marketplaces and cross-border e-commerce. From December 13, 2024, all non-food consumer products sold in the EU—including used, repaired, reconditioned, and handmade items—must comply with these new rules. However, there are exceptions for certain categories like medicinal products, food, and antiques.

The GPSR applies to all consumer products placed or made available on the market in the EU.

- Placing on the market is the initial supply to third parties, whether in return for payment or free of

charge, with the aim of distribution, consumption or use. - Making available means any supply of a product for distribution, consumption or use on the

market of the European Union in the course of a commercial activity, whether in return for

payment or free of charge. - Where a product is offered for sale online or by any other means of distance selling, the product

shall be deemed to be made available on the market if the offer is made to end-users in the

Union.

Consumer products are goods that are intended for consumers. Conversely, this means that products that are not intended for consumers and are unlikely to be used by consumers under reasonably foreseeable conditions are not covered by the regulation.

The regulation excludes the following product areas from the scope of application:

- Human and veterinary medicinal products

- Food and animal feed

- live plants and animals, animal by-products and derived products

- Plant protection products

- Means of transport and aircraft

- Antiques

Key Requirements: How to Stay Compliant

If you’re a seller or manufacturer, the GPSR demands a thorough approach to product compliance. Here’s a breakdown of the main requirements:

1. Appoint a Responsible Person

- Every product must have a designated Responsible Person based in the EU or Northern Ireland.

- Their contact information (postal and electronic addresses) must be displayed on the product, its packaging, or the accompanying documentation.

2. Update Product Labels and Information

- All safety warnings and product manuals must be provided in the local language of each EU country where the product is sold.

- Listings on platforms like Amazon must include safety information, infographics, and technical details.

3. Ensure Product Traceability

- Products must include identifiers such as model numbers, serial numbers, or CE markings.

- Manufacturers must provide detailed technical documentation, such as safety certifications and declarations of conformity.

4. Prepare for Marketplace Scrutiny

- Platforms like Amazon have strict protocols. Non-compliance could lead to:

- Listing deactivation.

- Loss of services like “Invoice by Amazon.”

- Additional compliance reviews for inventory already in fulfillment centers.

AMAZON EXAMPLE (GPSR: warning and safety information)

Marketplace Impacts: What Retailers Should Expect

Online marketplaces, including Amazon, are gearing up for the GPSR. These platforms will play a central role in enforcing compliance, with measures such as:

- Immediate deactivation of non-compliant listings.

- Displaying Responsible Person details and safety information directly on product pages.

- Introducing “Safety and Product Resources” sections to help consumers access compliance details easily.

Retailers should act now to avoid disruptions, especially if they sell across multiple platforms.

Challenges of Compliance

Compliance with the GPSR is no small feat. While appointing a Responsible Person and updating product information are critical steps, the process is resource-intensive. Retailers must:

- Gather and verify detailed product information.

- Translate safety documents into multiple EU languages.

- Upload compliance details across all sales platforms.

For smaller businesses, the costs of compliance—including Responsible Person fees and administrative overhead—can be prohibitive. Some sellers have already decided to stop selling in the EU altogether due to these challenges.

Why the GPSR Matters

The GPSR isn’t just about meeting regulatory requirements; it’s about building trust with consumers. The regulation emphasizes safety, transparency, and accountability, which are essential for maintaining a competitive edge in the European market.

Key benefits of compliance include:

- Enhanced consumer confidence in your products.

- Reduced risks of legal penalties and product recalls.

- A stronger reputation as a responsible and trustworthy brand.

How to Prepare for December 13

With the deadline fast approaching, here’s a checklist to help you get started:

- Audit Your Product Line: Identify all items subject to the GPSR.

- Appoint a Responsible Person: Secure a local partner or agency in the EU to fulfill this role.

- Update Labels and Documentation: Ensure all safety warnings and product manuals meet language and format requirements.

- Check Your Listings: Update product pages on marketplaces like Amazon with the required compliance information.

- Train Your Team: Educate staff about the new requirements and their impact on operations.

- Consult Experts: Work with legal and regulatory professionals to ensure full compliance.

What’s your take on the GPSR?

Are you ready for the changes, or do you see challenges ahead? Share your thoughts in the comments, and let’s discuss how businesses can adapt to these regulations effectively.

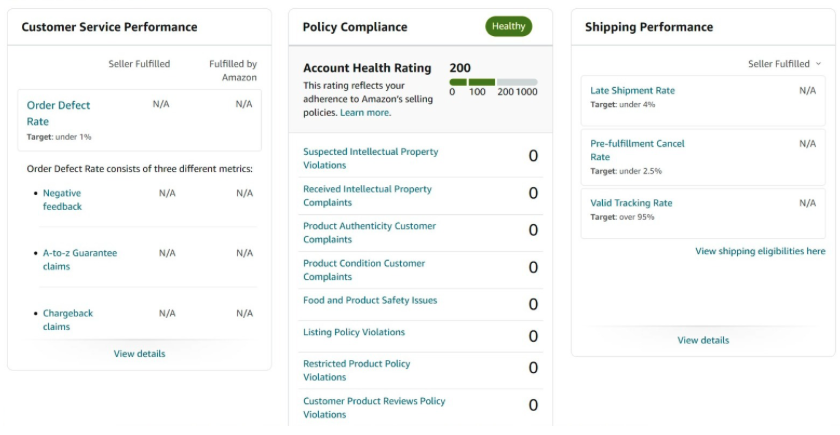

What is Account Health?

Account health encompasses key performance indicators (KPIs) that measure your store’s effectiveness, customer satisfaction, and operational reliability. Monitoring these KPIs helps you ensure smooth marketplace operations and a positive reputation.

EXAMPLE 1: AMAZON

Why Account Health Matters

- Enhanced Visibility: High-performing accounts often receive better rankings, which can translate to higher visibility and sales.

- Customer Trust: A strong performance history enhances your reputation and influences customer decisions.

- Reduced Risk of Account Suspension: Monitoring your account health protects against potential penalties, disruptions, and loss of business.

Key Metrics to Monitor

- Sales Quantity: Tracks the number of products sold within a specific period. Monitoring sales quantity helps identify seasonal trends, forecast inventory needs, and optimize supply chain management.

- Seller Response Time: Measures the time it takes to respond to customer inquiries or complaints. Quick responses improve customer satisfaction and reduce negative feedback.

- Customer Satisfaction Score (CSAT): A critical KPI reflecting customer happiness with your products or service, often gathered through post-purchase surveys. High CSAT scores can lead to better rankings and repeat customers.

- Return Rate: Tracks the percentage of items returned. High return rates may signal issues with product quality or misleading descriptions, prompting necessary improvements.

- Conversion Rate: Measures how many visitors complete a purchase. A higher conversion rate typically reflects effective product listings, accurate descriptions, and engaging marketing efforts.

- Churn Rate: Indicates how quickly customers stop purchasing within a set timeframe. High churn suggests issues with customer loyalty or satisfaction, which need to be addressed.

- Retention Rate: The inverse of churn, this metric shows the percentage of repeat customers. High retention rates indicate strong customer loyalty and consistent satisfaction.

- Product Policy Compliance: This refers to the adherence to specific rules and guidelines set by Amazon regarding the products that sellers list and sell on the platform. These policies are designed to ensure that all products meet certain standards for safety, legality, and quality, and that they are accurately represented to customers.

- Compliance with Other Regulations: Depending on the product category, there may be additional regulations to follow.

Example of Operational Control:

Benefits for Sellers Operating Across Multiple Channels

- Simplified Monitoring: Managing multiple platforms can be overwhelming, but monitoring account health helps consolidate performance data across channels. Instead of juggling different dashboards, sellers can get a holistic view of their performance from a single place, saving time and reducing complexity.

- Winning the Buy Box: Many marketplaces, like Amazon, have a Buy Box that significantly boosts visibility and sales potential. Optimizing your account health and performance metrics increases your chances of winning the Buy Box across various channels, positioning your products as top choices for customers.

- Boost Your Market Presence: A strong account health score enhances your credibility, which, in turn, can improve visibility on multiple marketplaces. Mastering and maintaining these metrics helps amplify your brand presence, leading to greater reach and recognition across channels.

Tips for Maintaining a Healthy Account

- Daily Monitoring: Make it a routine to check your dashboard to address issues promptly.

- Set Automated Alerts: Use alerts to stay updated on significant KPI changes or thresholds.

- Effective Customer Communication: Ensure timely responses to maintain high satisfaction scores.

- Optimized Inventory Management: Balance supply and demand to minimize stockouts and excessive returns.

Conclusion

Prioritizing account health through regular monitoring of KPIs not only ensures compliance with marketplace standards but also enhances the customer experience, helping you build a sustainable and profitable business on marketplaces like Amazon, Bol, Kaufland, and Metromakro and other Marketplaces.

]]>In this blog, we’ll dive into the most frequent missteps and share 13 essential tips to help you navigate the marketplace landscape successfully. If you’re serious about making the most of your marketplace journey.

Common Mistakes to Avoid

Before jumping into our tips, let’s look at some mistakes sellers often make:

- Setting unclear objectives: Without defined goals and strategies, sellers often flounder. It’s crucial to establish your “how” and “why” before opening a marketplace account.

- Lack of internal alignment: A “one-man show” approach won’t cut it. Marketplaces require a team effort across various departments such as logistics, marketing, and customer service.

- Listing an unsuitable product assortment: Not all your products will work on every marketplace. It’s important to research and select the best products for each platform.

- Inconsistent branding across channels: Disjointed pricing, product information, and messaging across your different sales channels can confuse consumers and even cannibalize your own business.

Now that we’ve covered the pitfalls, let’s focus on how to set yourself up for success.

The 13 Top Tips to Start Selling on Marketplaces

1. Choose the Right Marketplace

While Amazon dominates globally, there are several niche platforms that might be a better fit for your brand, depending on your industry. Amazon, Cdiscount, Allegro, and Bol.com are just a few examples. Research marketplaces that align with your product categories and business goals, considering their specific entry requirements and services.

2. Select the Right Products

Start small. Rather than listing your entire catalog, choose products that are easily recognizable, have high margins, and generate fewer returns. Testing with a sample set will help you fine-tune your approach.

3. Create an Account

Once you’ve chosen your marketplace, create an account and familiarize yourself with the settings and dashboard tools. If you’re a brand, let the marketplace know. They may give you more control over your content.

4. List Your Products in the Right Categories

Getting your product into the correct category is critical. It ensures that customers can find your items quickly. Be as specific as possible when uploading product details.

5. Set Up Logistics

Choose how to manage logistics: in-house, with a partner, or outsourced to the marketplace. Some marketplaces even offer fulfillment services that could give you an edge in search results.

6. Optimize Your Content

Content is king. Unlike your website, marketplaces have fierce competition right next to you. Invest time in your product titles, descriptions, images, and keywords. The more engaging and detailed your content, the more likely you are to stand out.

7. Ensure Marketplace and Country Compliance

Selling on marketplaces often requires adhering to marketplace-specific policies as well as the legal requirements of the country where you are selling. Make sure your products comply with safety regulations, taxes (like VAT), and import/export laws. Non-compliance can lead to account suspension or even hefty fines. Understanding each country’s legal requirements is crucial for long-term marketplace success.

8. Start Selling

Congrats, you’re live! But the work doesn’t stop there. Now is when the real effort begins.

9. Collect Reviews

As sales start to roll in, encourage customers to leave genuine reviews. Aim for at least 15 reviews per product to improve credibility and search rankings. Responding to negative feedback promptly can also help build trust.

10. Launch Advertising Campaigns

Initially, your products might not perform well due to lack of visibility. Use the promotional and advertising tools available on each marketplace to boost your products. Start with special offers to generate early sales and reviews.

11. Review Results and Optimize

Use the data you gather to refine your content, improve delivery times, and optimize future advertising campaigns.

12. Expand Your Product Range

Once you’ve fine-tuned your approach, gradually introduce more products. Keep testing and improving the process.

13. Consider New Marketplaces

With your marketplace presence now well-established, it’s time to consider expanding to new platforms. Each one may offer unique opportunities to grow your brand.

By following these steps, you’ll be well on your way to achieving marketplace success. Remember, the journey doesn’t stop once you’re live. It requires ongoing analysis, adjustment, and optimization to keep pushing your business forward.

Want more in-depth advice? Check out our latest webinar, “The Importance of Selling in Different Marketplaces.”

]]>

Welcome to the August edition of TFE Talk! This month, we’re diving into the latest trends and insights from June, providing a comprehensive look at how e-commerce is evolving and shaping the global market. From B2B revenue strategies to European marketplace dynamics, here’s everything you need to know.

1.  Scaling Revenue through Ecommerce: A 2024 Priority for B2B Organizations.

Scaling Revenue through Ecommerce: A 2024 Priority for B2B Organizations.

As we hit the mid-year mark, B2B organizations are prioritizing ecommerce to scale their revenue and operations. According to a survey by Algolia involving 700 manufacturers and distributors across North America and Europe:

- Shifting Revenue: 53% are focusing on transitioning from offline to ecommerce channels. Yet, a significant 74% of revenue still stems from offline sources.

- Revenue Opportunity: Investments in ecommerce are expected to increase the online revenue share from 26% and boost overall profitability.

- Key Findings:

- 61% of online orders are a mix of large and small value products.

- 58% of B2B buyers make weekly or more frequent purchases through ecommerce.

- 32% acknowledge poor search functionality as a major issue.

Nearly half of B2B organizations are either investing in or planning to invest in ecommerce this year. The strategy is clear: scale revenue by shifting to ecommerce channels.

2. Expanding Horizons: The Strategic Advantage of European E-Commerce for U.S. Brands.

With over 500 million consumers in Europe, U.S. e-commerce brands have a unique opportunity for expansion. Europe offers a lucrative market with higher average spending compared to the U.S., and less saturation on platforms like Amazon.

- Market Trends: Marketplaces are the primary drivers of e-commerce growth in Europe, with Amazon dominating the UK and Germany, but local players like Allegro in Poland and Bol.com in the Netherlands also play significant roles.

- Challenges: Expanding into Europe requires navigating diverse regulations, cultural nuances, and market-specific logistics. A phased approach is recommended, starting with thorough market research and targeted entry into key countries.

3.  Breaking Barriers in E-commerce: Only 1% of U.S. Amazon Sellers Go Global

Breaking Barriers in E-commerce: Only 1% of U.S. Amazon Sellers Go Global

Despite Amazon’s global presence, fewer than 1% of U.S. sellers venture beyond North America. Key insights from Marketplace Pulse reveal:

- Limited Global Reach: Only 12% of U.S. sellers operate on Amazon Canada, and 5% on Amazon Mexico. Many utilize Remote Fulfillment with FBA to sell in Canada, Mexico, and Brazil without maintaining local inventory.

- Comparative Success: U.S. sellers have greater success in Canada than Canadian sellers, thanks to geographic proximity.

- Missed Opportunities: Major international markets like Japan, Germany, and the U.K. remain largely untapped by U.S. sellers. More sellers from Japan and the U.K. sell in the U.S. than vice versa.

Despite the extensive reach of Amazon’s 22 international marketplaces, cross-border selling is still limited. European and Japanese sellers primarily focus on their local markets, while U.S. sellers remain concentrated in North America. However, Amazon’s international markets combined are as large as the U.S. market, presenting substantial opportunities for those willing to expand globally.

4.  European Ecommerce Soars in 2023: Key Trends.

European Ecommerce Soars in 2023: Key Trends.

European e-commerce saw an 8% growth in 2023, approaching €1 trillion. Key trends include:

- Pandemic-Driven Shifts: Online shopping habits established during lockdowns are now permanent.

- Market Maturation: High service levels are now expected, with fast delivery and BOPIS becoming standard.

- Cross-Border Expansion: Western Europe leads in online sales, while Eastern Europe shows growth potential.

- Fashion and Second-Hand Market: Fashion dominates online purchases, and the second-hand market is thriving, with 87% of Europeans participating.

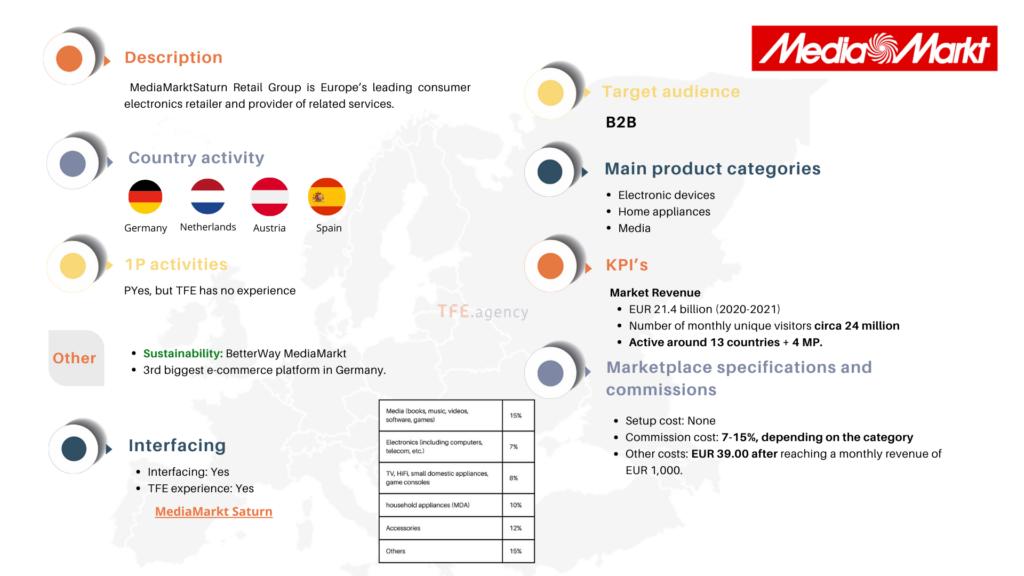

5.  MediaMarkt’s Marketplace Sales Double as Ceconomy Sees Strong Q3 Growth!

MediaMarkt’s Marketplace Sales Double as Ceconomy Sees Strong Q3 Growth!

CeCeconomy, the parent company of MediaMarkt and Saturn, reported robust results for Q3:

- Revenue Growth: Ceconomy’s revenue increased by 6.6% to €4.92 billion, with comparable sales rising by 5.2%.

- Marketplace Success: MediaMarkt’s marketplace trading volume more than doubled within the past year.

- Online Sales Surge: Ceconomy’s online sales grew by nearly 10%, now comprising 22.2% of total sales.

- Profitability Improvement: Adjusted EBIT is projected to reach around €300 million for the fiscal year.

- Key Drivers: Success attributed to marketplaces, retail media, and a boost from TV sales related to the European Football Championship.

Future Goals: MediaMarkt aims for a GMV of €750 million by 2026, with its marketplace expansion across Germany, Austria, Spain, the Netherlands, and Italy. Ceconomy also achieved its highest-ever Net Promoter Score (NPS), increasing by 6 points to 61.

Key Takeaways:

Highest NPS: +6 points to 61

Revenue growth: +6.6% to €4.92B

Marketplace sales: Doubled in the last quarter

GMV target: €750M by 2026

6. Kaufland Launches Marketplace in Poland.

Kaufland has entered Poland’s ecommerce scene, challenging Allegro and Amazon. With 245 local stores and a trusted brand, Kaufland aims for rapid growth in Poland’s ecommerce market.

- Expansion: Polish retailers on Kaufland’s platform can easily access European markets through international fulfillment services.

7.  The Role of Marketplaces in European Ecommerce: A Dynamic Shift in Shopping Habits.

The Role of Marketplaces in European Ecommerce: A Dynamic Shift in Shopping Habits.

Marketplaces are reshaping European e-commerce, capturing 42% of consumer web traffic among Europe’s Top 1000 websites. Key players include:

- Leaders: Amazon leads with 20% of traffic, followed by eBay with 8% and AliExpress with 5%.

- European Giants: Allegro and Zalando are major players in Central and Eastern Europe.

- Future Trends: 35% of online purchases happen on marketplaces, projected to rise to 60% by 2027.

Marketplaces are setting new standards in shopping convenience and variety, significantly influencing consumer behavior.

]]>Why Go Global? The Benefits of European Expansion

With over 500 million consumers across key countries like Germany, the UK, France, Italy, and Spain, Europe represents a target market that is not only large but also financially robust. According to Bob, the average spending per person in Europe often surpasses that of other regions, including the U.S. This fact alone makes Europe an attractive destination for U.S. brands looking to expand their customer base.

Additionally, the competitive landscape in Europe, particularly on platforms like Amazon, is less saturated compared to the U.S. market. With fewer sellers and a growing number of online shoppers, U.S. brands have a unique opportunity to gain traction quickly and establish a strong presence in Europe.

Marketplace Growth and Trends

Marketplaces are the driving force behind e-commerce growth in Europe, with 82% of the increase coming from these platforms. Amazon is a dominant player in the UK and Germany, but it is not the sole leader across all markets. In Poland, local players like Allegro hold significant market share, while in the Netherlands, Bol.com is a key competitor.

New entrants like Tesco have also launched marketplaces, with Tesco’s recent UK venture showing promising potential. Despite Amazon’s dominance, other marketplaces such as Cdiscount in France and Allegro in Poland are crucial players in their respective markets.

The Challenges of European Expansion

Despite the clear benefits, expanding into Europe is not without its challenges. Unlike the U.S., Europe is not a single country but a collection of nations, each with its own regulations, cultural nuances, and consumer behaviors. A successful European strategy requires a localized approach. This means setting up operations in specific countries, obtaining local VAT numbers, hiring local staff for customer support and marketing, and navigating the complexities of compliance and logistics.

For many U.S. brands, the prospect of managing multiple operations across different countries can be daunting. The need for a local presence in each target market can lead to significant upfront investments, often before any revenue is generated. This complexity is one of the primary reasons why less than 2% of U.S. brands currently sell in Europe, despite the market’s potential.

A Strategic Approach to European E-Commerce

To overcome these challenges, TFE recommends a strategic, phased approach to European expansion. Rather than attempting to enter the entire European market at once, U.S. brands should start by analyzing key markets to identify the top countries where their products are likely to succeed. This involves conducting thorough market research, competitor analysis, and pricing strategy assessments to determine where the brand’s offerings will be most competitive.

Once the target markets are identified, brands can then create a roadmap for setting up operations, ensuring they have the necessary infrastructure in place before launching.

Getting Started in European Marketplaces

Entering the European market involves several key steps:

- Market Knowledge: Understand the market structure, language preferences, and local consumer behavior.

- VAT and Compliance: Navigate varying VAT rates and compliance requirements for different countries.

- Technology and Fulfillment: Utilize software solutions for seamless integration and ensure efficient fulfillment processes.

- Customer Service: Localize customer service to handle requests effectively, with most queries coming via email.

- Content Adaptation: Leverage existing Amazon content as a foundation for other marketplaces, ensuring it meets local requirements.

Conclusion

Expanding into European marketplaces presents numerous opportunities but requires a strategic approach. Understanding the diverse and fragmented landscape is essential for success. By focusing on key markets, leveraging the growth of various product categories, and adapting to local requirements, brands can effectively tap into Europe’s vast consumer base.

For further insights and personalized guidance on navigating the European market, feel free to reach out.

]]>

Welcome to the second edition of TFE Talk! This month, we have an exciting lineup of updates, trends, and insights to help you stay ahead in the ever-evolving world of e-commerce. Let’s dive in!

Partnership with ChannelEngine

At TFE, we firmly believe that strong partnerships are the cornerstone of growth and innovation in today’s dynamic business landscape. By aligning with ChannelEngine, we are not only expanding our capabilities but also enhancing the value we bring to our clients.

Why Partnerships Matter:

Why Partnerships Matter:

- Access to Expertise: Collaborating with industry leaders like ChannelEngine allows us to leverage their expertise and cutting-edge technology to deliver top-notch solutions.

- Innovation & Growth: Strategic partnerships drive innovation, helping us stay ahead of market trends and continuously improve our services.

- Enhanced Service Offerings: By joining forces, we can offer our clients a more comprehensive suite of services, tailored to meet their unique needs.

- Mutual Success: Partnerships are about creating win-win scenarios. Together with ChannelEngine, we aim to achieve greater success for both our clients and our agency.

This partnership is a testament to our commitment to providing exceptional service and staying at the forefront of the e-commerce industry. We are excited about the opportunities this collaboration will bring and look forward to driving success for our clients together with ChannelEngine.

Stay tuned for more updates on how this partnership will enhance our offerings and support your business growth!

Important Update for Merchant Partners!

Important Update for Merchant Partners!

The Rue du Commerce business will soon be transferred to the LDLC group, marking a significant milestone in their journey and opening up new opportunities.

What Does This Mean for You?

What Does This Mean for You?

- Seamless Transition: On April 5, 2024, Rue du Commerce (RDC) transferred its business operations to Groupe LDLC, a leading player in the high-tech and IT product market. The official transfer of ownership is expected to take place around mid-July 2024.

- Unchanged Contracts: Current contracts and terms with Rue du Commerce will remain unchanged, with the only difference being the new co-contractor, Groupe LDLC.

- User Experience: The user experience on the platform will stay exactly the same.

- Continuous Updates: Groupe LDLC will keep everyone informed with updates as the transition progresses.

This transition is expected to bring new growth and opportunities for all merchant partners.

Top Consumer Electronics Trends to Watch in 2024!

Top Consumer Electronics Trends to Watch in 2024!

Want to know what’s moving the electronics market today? Get insights from thought leaders and experts in consumer electronics eCommerce sales.

Electronics is a fantastic business to be in – as long as everything runs perfectly. The fundamentals are great: high value per item, healthy margins, and durable stock. But eCommerce comes with unique challenges for electronics brands and multi-brand retailers, making it harder to reach full potential.

Marketplaces to the Rescue! Significant horizontal marketplaces like Amazon, eBay, and Shopee reach vast audiences, while local heroes like Bol.com, Mercado Libre, and Allegro leverage regional prominence. Together, they drive a staggering volume of consumer electronics sales.

Marketplaces to the Rescue! Significant horizontal marketplaces like Amazon, eBay, and Shopee reach vast audiences, while local heroes like Bol.com, Mercado Libre, and Allegro leverage regional prominence. Together, they drive a staggering volume of consumer electronics sales.

Challenges Ahead

Challenges Ahead

- Crowded Market: Tough competition from cheap, ‘no-brand’ competitors makes it harder for new, high-quality brands to gain exposure.

- Sustainability: Rapidly cycling trends and environmental concerns influence buyer behavior.

Standing Out in the Crowd Consumers face choice overload, leading to confusion and frustration. But sellers who distinguish themselves with quality, excellent service, and extended guarantees can attract more buyers. Marketplaces guide customers to the best products, ensuring satisfaction and the best price for quality devices.

Standing Out in the Crowd Consumers face choice overload, leading to confusion and frustration. But sellers who distinguish themselves with quality, excellent service, and extended guarantees can attract more buyers. Marketplaces guide customers to the best products, ensuring satisfaction and the best price for quality devices.

Sustainability and E-Waste The electronics industry is shifting towards design based on circular economy principles, responsible production, and sustainable manufacturing. Extending the lifespan of products and enhancing upgradability and recyclability are crucial. The market for refurbished and used electronics is growing, reflecting consumer demand for sustainability.

Sustainability and E-Waste The electronics industry is shifting towards design based on circular economy principles, responsible production, and sustainable manufacturing. Extending the lifespan of products and enhancing upgradability and recyclability are crucial. The market for refurbished and used electronics is growing, reflecting consumer demand for sustainability.

Embracing D2C Models Direct-to-consumer (D2C) and service-based models are gaining traction, offering brands greater control over supply chains, customer experiences, and pricing. Digital transformation is making D2C models more scalable and cost-effective.

Embracing D2C Models Direct-to-consumer (D2C) and service-based models are gaining traction, offering brands greater control over supply chains, customer experiences, and pricing. Digital transformation is making D2C models more scalable and cost-effective.

Tech Innovations on the Horizon AI, machine learning, IoT, and 5G are set to revolutionize the consumer electronics industry. These technologies will drive personalized user experiences, real-time data processing, and enhanced scalability.

Tech Innovations on the Horizon AI, machine learning, IoT, and 5G are set to revolutionize the consumer electronics industry. These technologies will drive personalized user experiences, real-time data processing, and enhanced scalability.

Expanding Your Business into the European Market: Key Insights

Expanding your business into the European market can be a game-changer. Here are some key insights to consider:

- Market Knowledge: Understand the cultural and economic differences across European countries.

- VAT Management: Ensure compliance with VAT regulations to avoid legal issues.

- Technology & Fulfillment: Invest in technology and logistics to meet customer expectations.

- Customer Service: Provide excellent customer service to build trust and loyalty.

- Content Localization: Tailor your content to resonate with local audiences.

Are you looking to expand your business into one of the largest e-commerce markets in Europe? Look no further than Amazon Germany!

Are you looking to expand your business into one of the largest e-commerce markets in Europe? Look no further than Amazon Germany!

Amazon Germany offers vast opportunities for growth with its large customer base and established infrastructure. Here are some tips to get started:

- Compliance: Ensure your products meet local regulations and standards.

- Logistics: Utilize Amazon’s FBA (Fulfillment by Amazon) to streamline operations.

- Marketing: Leverage Amazon’s advertising tools to increase visibility and sales.

6.  German eCommerce Shows Signs of Growth

German eCommerce Shows Signs of Growth

Q2 Growth: Online sales in Germany increased by 0.2% compared to the same period last year, marking the first growth in two years. Total online sales from April to June reached €19.2 billion.

Q2 Growth: Online sales in Germany increased by 0.2% compared to the same period last year, marking the first growth in two years. Total online sales from April to June reached €19.2 billion.

H1 2024 Performance: Despite the recent growth, sales in the first half of 2024 are still 1.2% lower than the same period in 2023, with total revenue at €38.1 billion.

H1 2024 Performance: Despite the recent growth, sales in the first half of 2024 are still 1.2% lower than the same period in 2023, with total revenue at €38.1 billion.

Digital Services Boom: The largest driver behind this growth is digital services, including travel bookings and ticket purchases, which saw a 4.2% increase in Q2, reaching €3.72 billion.

Digital Services Boom: The largest driver behind this growth is digital services, including travel bookings and ticket purchases, which saw a 4.2% increase in Q2, reaching €3.72 billion.

Product Range Growth: Sales grew in 12 of the 19 surveyed product ranges. Notably, food orders surged by 6.2% to €1.004 billion, and furnishings saw a 1.6% increase.

Product Range Growth: Sales grew in 12 of the 19 surveyed product ranges. Notably, food orders surged by 6.2% to €1.004 billion, and furnishings saw a 1.6% increase.

Marketplaces Leading the Way: Online marketplaces have been pivotal, growing 2.3% in Q2 and securing a 55% market share for H1 2024.

Marketplaces Leading the Way: Online marketplaces have been pivotal, growing 2.3% in Q2 and securing a 55% market share for H1 2024.

Amazon DE, the second-largest marketplace globally after Amazon US, offers unparalleled opportunities for sellers looking to expand into Europe. With its robust market size, strong buying power, and manageable competition, Amazon.de is a prime destination for ambitious sellers.

Amazon Germany Key Facts – Is it Worth It?

Amazon Germany isn’t just big; it’s pivotal in European e-commerce. Here are five compelling reasons to sell on Amazon.de:

- Big Market, Strong Buying Power: Germans are enthusiastic online shoppers with a penchant for quality products. They allocate a significant portion of their income to consumer goods, making them ideal customers.

- Easy Targeting: Germans are familiar with Western marketing styles and communication, making it easier for US sellers to adapt their strategies without extensive localization.

- High Demand, Low Competition: The relatively low competition combined with high demand creates a fertile ground for increasing sales and revenue.

- Preference for Online Shopping: A staggering 84% of Germans use Amazon regularly, ensuring high market penetration and steady customer traffic.

- Willingness to Pay for Quality: Germans value quality and are willing to pay premium prices for high-quality products. This preference translates to higher average order values.

How Does Amazon Europe Work?

Amazon Europe operates seamlessly across multiple EU countries, facilitating expansion beyond Germany with integrated marketplace accounts. When you sign up for an Amazon Seller account in Europe, you get access to other major EU marketplaces like Italy, France, Spain, and the Netherlands. This interconnected structure allows for easier regional expansion, although success in each market requires dedicated efforts and strategic planning.

Expanding your business into the European market: Key Insights

How to Know if Amazon Germany is Right for You

Before diving into Amazon Germany, evaluate if your product aligns with the market:

- Market Research: Study consumer behavior, market demand, and existing competition to determine if there’s a viable market for your product.

- Product Adaptation: While Germans appreciate US brands, consider cultural preferences and potential product modifications.

- Amazon TOS Compliance: Ensure your products meet Amazon Germany’s Terms of Service and aren’t restricted.

- Regulatory Standards: Germany has stringent regulations, especially regarding product safety and consumer protection. Compliance is crucial to avoid legal issues.

Product Compliance for the European Market

Compliance with EU regulations is non-negotiable. Key requirements include:

- REACH Regulation: Focuses on the safety of chemical substances to protect human health and the environment.

- CE Marking: Indicates that a product meets EU safety, health, and environmental protection standards, essential for electrical products.

- LFGB and the Glass & Fork Label: Pertains to products that come into contact with food, ensuring they are safe for use.

- Certificate of Conformity: Proves that your products meet necessary regulations. Partnering with certified testing labs is advisable to ensure thorough compliance.

Forwarding Your Products to Germany

Shipping and fulfillment are critical steps:

- Choose the Right Freight Forwarder: Select a forwarder experienced in shipping to Europe to navigate logistical challenges and customs regulations.

- Decide on Fulfillment Method:

- Local Inventory: Managing your own fulfillment can be complex but allows for complete control over the customer experience.

- Fulfillment By Amazon (FBA): Preferred by many sellers for its efficiency and customer trust. However, it requires compliance with Amazon’s logistical and regulatory standards.

Local vs. International Sellers

There are two primary approaches:

- For New Sellers: Register an Amazon.de account with necessary documentation, such as a VAT identification number, business registration, and a valid payment method.

- For Existing International Sellers: Expand your current Amazon business to Germany, adapting your listings and fulfillment processes to meet local requirements.

Best Practices For a Successful Sale on Amazon Germany

Success hinges on several key factors:

- Ratings: Build trust by ensuring timely deliveries and addressing customer issues promptly. Positive reviews are crucial for credibility.

- Product Evaluations: Ensure accurate product descriptions and high-quality images to avoid negative reviews due to unmet expectations.

- Competitive Pricing: Set prices that are competitive yet reflect the quality of your products to attract discerning German buyers.

- Translations and Localization: Accurate translations are essential. Work with specialized agencies to ensure your listings resonate with German customers, focusing on clarity and factual information rather than flashy marketing.

Conclusion

Selling on Amazon Germany offers immense potential but requires meticulous planning and adherence to stringent regulations. Ensure product compliance, conduct thorough market research, and consider professional advice for a smooth entry into this lucrative market.

About TFE Agency

TFE Agency specializes in global expansion strategies, providing tailored expertise to help businesses thrive on Amazon Germany and beyond. Contact us for personalized guidance and support in your expansion journey.

]]>

Welcome to the first edition of TFE Talk, where we bring you the latest insights and developments in the e-commerce industry. June has been an exciting month, filled with significant milestones and emerging trends. Let’s dive into the highlights!

European eCommerce Market in 2024: Heading Towards $1 Trillion!

European eCommerce Market in 2024: Heading Towards $1 Trillion!

The European eCommerce market is on an impressive trajectory, set to reach the $1 trillion mark in 2024. This growth is fueled by increasing consumer confidence, technological advancements, and a surge in online shopping activities. Retailers are continuously adapting to meet the evolving demands of tech-savvy consumers, offering personalized shopping experiences and efficient delivery services.

Sustainability in E-Commerce: A Path to a More Responsible Future

As the world becomes more environmentally conscious, sustainability in e-commerce is gaining momentum. Businesses are adopting responsible practices, from using sustainable packaging materials to optimizing supply chains for reduced carbon footprints. This shift towards sustainability is not only beneficial for the planet but also resonates with consumers who prioritize responsible shopping.

Tesco Launches Online Marketplace

Tesco Launches Online Marketplace

In a bid to expand its digital footprint, Tesco has launched its online marketplace, offering a wide range of products from third-party sellers. This move is set to enhance the shopping experience for Tesco’s customers, providing them with more choices and competitive prices. The marketplace is designed to support small and medium-sized enterprises, giving them a platform to reach a broader audience.

Expanding The Horizon Of Your US Brand: The Opportunities of Selling on European Marketplaces

Expanding into the European market presents a plethora of opportunities for US brands. With diverse consumer preferences and a robust digital infrastructure, Europe offers a fertile ground for growth. Our recent webinar explored strategies for American brands to successfully enter and thrive in European marketplaces, featuring insights from industry leaders like Gordon Christiansen, Stuart Conroy, Bob Boekema, and Wayne Gibson.

If you want to see the complete webinar, led by Highlands, click on the following URL: Navigating the European Market from the US

Austrian Online Shopping Trends!

Austria is emerging as a dynamic player in the e-commerce landscape. Austrian consumers are increasingly turning to online shopping for convenience and variety. Key trends include a preference for mobile shopping, the rise of local marketplaces, and a growing interest in sustainable products. Understanding these trends can help businesses tailor their strategies to meet the needs of Austrian shoppers.