TFE Talk – August 2024

Welcome to the August edition of TFE Talk! This month, we’re diving into the latest trends and insights from June, providing a comprehensive look at how e-commerce is evolving and shaping the global market. From B2B revenue strategies to European marketplace dynamics, here’s everything you need to know.

1. 🚀 Scaling Revenue through Ecommerce: A 2024 Priority for B2B Organizations. 🚀

As we hit the mid-year mark, B2B organizations are prioritizing ecommerce to scale their revenue and operations. According to a survey by Algolia involving 700 manufacturers and distributors across North America and Europe:

- Shifting Revenue: 53% are focusing on transitioning from offline to ecommerce channels. Yet, a significant 74% of revenue still stems from offline sources.

- Revenue Opportunity: Investments in ecommerce are expected to increase the online revenue share from 26% and boost overall profitability.

- Key Findings:

- 61% of online orders are a mix of large and small value products.

- 58% of B2B buyers make weekly or more frequent purchases through ecommerce.

- 32% acknowledge poor search functionality as a major issue.

Nearly half of B2B organizations are either investing in or planning to invest in ecommerce this year. The strategy is clear: scale revenue by shifting to ecommerce channels.

2. Expanding Horizons: The Strategic Advantage of European E-Commerce for U.S. Brands.

With over 500 million consumers in Europe, U.S. e-commerce brands have a unique opportunity for expansion. Europe offers a lucrative market with higher average spending compared to the U.S., and less saturation on platforms like Amazon.

- Market Trends: Marketplaces are the primary drivers of e-commerce growth in Europe, with Amazon dominating the UK and Germany, but local players like Allegro in Poland and Bol.com in the Netherlands also play significant roles.

- Challenges: Expanding into Europe requires navigating diverse regulations, cultural nuances, and market-specific logistics. A phased approach is recommended, starting with thorough market research and targeted entry into key countries.

3. 🌍 Breaking Barriers in E-commerce: Only 1% of U.S. Amazon Sellers Go Global 🌍

Despite Amazon’s global presence, fewer than 1% of U.S. sellers venture beyond North America. Key insights from Marketplace Pulse reveal:

- Limited Global Reach: Only 12% of U.S. sellers operate on Amazon Canada, and 5% on Amazon Mexico. Many utilize Remote Fulfillment with FBA to sell in Canada, Mexico, and Brazil without maintaining local inventory.

- Comparative Success: U.S. sellers have greater success in Canada than Canadian sellers, thanks to geographic proximity.

- Missed Opportunities: Major international markets like Japan, Germany, and the U.K. remain largely untapped by U.S. sellers. More sellers from Japan and the U.K. sell in the U.S. than vice versa.

Despite the extensive reach of Amazon’s 22 international marketplaces, cross-border selling is still limited. European and Japanese sellers primarily focus on their local markets, while U.S. sellers remain concentrated in North America. However, Amazon’s international markets combined are as large as the U.S. market, presenting substantial opportunities for those willing to expand globally.

4. 🚀 European Ecommerce Soars in 2023: Key Trends.

European e-commerce saw an 8% growth in 2023, approaching €1 trillion. Key trends include:

- Pandemic-Driven Shifts: Online shopping habits established during lockdowns are now permanent.

- Market Maturation: High service levels are now expected, with fast delivery and BOPIS becoming standard.

- Cross-Border Expansion: Western Europe leads in online sales, while Eastern Europe shows growth potential.

- Fashion and Second-Hand Market: Fashion dominates online purchases, and the second-hand market is thriving, with 87% of Europeans participating.

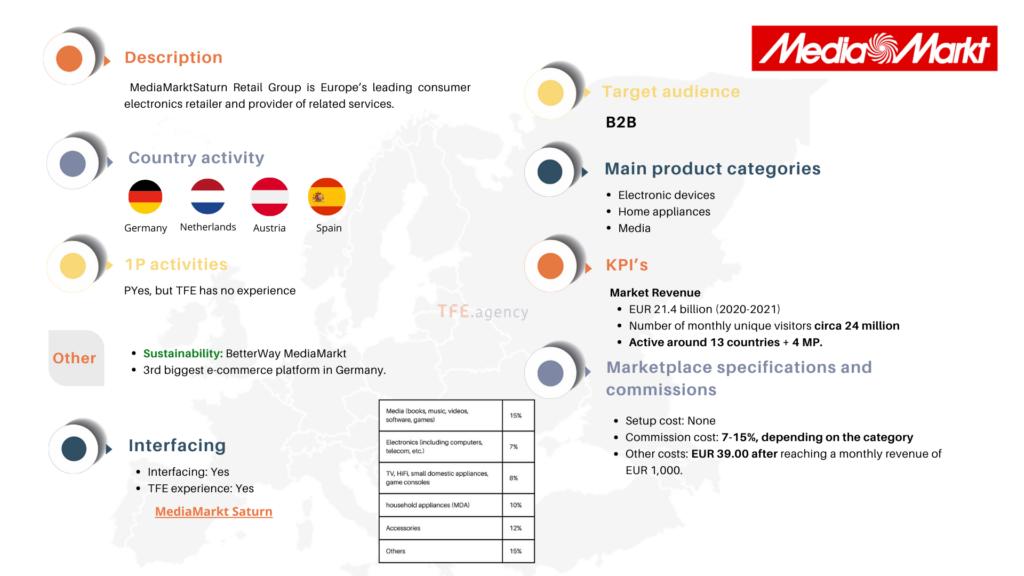

5. 🚀 MediaMarkt’s Marketplace Sales Double as Ceconomy Sees Strong Q3 Growth!

CeCeconomy, the parent company of MediaMarkt and Saturn, reported robust results for Q3:

- Revenue Growth: Ceconomy’s revenue increased by 6.6% to €4.92 billion, with comparable sales rising by 5.2%.

- Marketplace Success: MediaMarkt’s marketplace trading volume more than doubled within the past year.

- Online Sales Surge: Ceconomy’s online sales grew by nearly 10%, now comprising 22.2% of total sales.

- Profitability Improvement: Adjusted EBIT is projected to reach around €300 million for the fiscal year.

- Key Drivers: Success attributed to marketplaces, retail media, and a boost from TV sales related to the European Football Championship.

Future Goals: MediaMarkt aims for a GMV of €750 million by 2026, with its marketplace expansion across Germany, Austria, Spain, the Netherlands, and Italy. Ceconomy also achieved its highest-ever Net Promoter Score (NPS), increasing by 6 points to 61.

Key Takeaways:

Highest NPS: +6 points to 61

Revenue growth: +6.6% to €4.92B

Marketplace sales: Doubled in the last quarter

GMV target: €750M by 2026

6. Kaufland Launches Marketplace in Poland.

Kaufland has entered Poland’s ecommerce scene, challenging Allegro and Amazon. With 245 local stores and a trusted brand, Kaufland aims for rapid growth in Poland’s ecommerce market.

- Expansion: Polish retailers on Kaufland’s platform can easily access European markets through international fulfillment services.

7. 🌐 The Role of Marketplaces in European Ecommerce: A Dynamic Shift in Shopping Habits.

Marketplaces are reshaping European e-commerce, capturing 42% of consumer web traffic among Europe’s Top 1000 websites. Key players include:

- Leaders: Amazon leads with 20% of traffic, followed by eBay with 8% and AliExpress with 5%.

- European Giants: Allegro and Zalando are major players in Central and Eastern Europe.

- Future Trends: 35% of online purchases happen on marketplaces, projected to rise to 60% by 2027.

Marketplaces are setting new standards in shopping convenience and variety, significantly influencing consumer behavior.